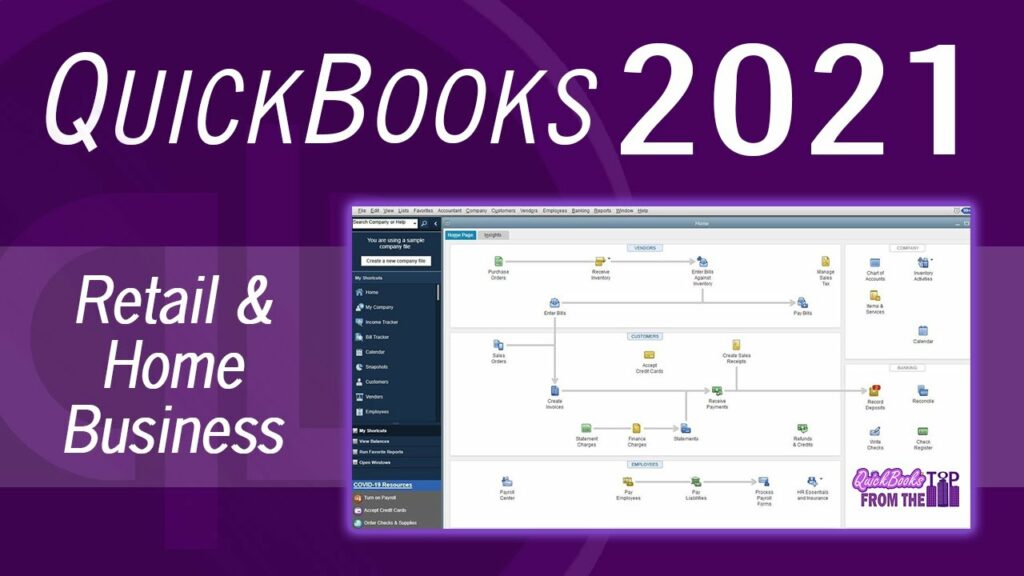

How to Set Up QuickBooks for Retail

Setting up QuickBooks for retail involves configuring the software to effectively manage inventory, sales transactions, customer information, and financial reporting tailored to retail operations. This comprehensive guide covers everything from initial setup to advanced configurations, ensuring you can leverage QuickBooks to streamline retail management effectively.

1. Choosing the Right QuickBooks Version for Retail

A. QuickBooks Online vs. QuickBooks Desktop

1. QuickBooks Online

- Accessibility: Accessible from anywhere with internet connectivity.

- Automatic Updates: Regular updates without manual installations.

- Collaboration: Supports multiple users simultaneously.

2. QuickBooks Desktop

- One-time Purchase: No recurring subscription fees.

- Customization: Greater control over data and security.

- Advanced Features: Comprehensive tools for complex retail needs.

B. Determine Your Retail Needs

1. Inventory Management

- Track products, variations, and stock levels.

- Manage purchase orders and vendor relationships.

2. Sales and Point of Sale (POS)

- Process transactions, discounts, and returns.

- Integrate with POS systems for seamless sales operations.

3. Customer Relationship Management (CRM)

- Capture customer data and preferences.

- Segment customers for targeted marketing and loyalty programs.

2. Setting Up QuickBooks for Retail

A. Initial Setup

1. Company Information

- Enter business details: name, address, contact information.

- Customize invoices, receipts, and sales forms.

2. Chart of Accounts

- Create accounts for sales, cost of goods sold (COGS), expenses, etc.

- Tailor accounts to retail-specific categories (e.g., Merchandise Sales, Discounts Given).

B. Configure Preferences

1. Sales and Customers

- Set default terms for sales transactions (e.g., payment terms, invoice delivery).

- Customize sales forms to include necessary fields (e.g., customer messages, shipping details).

2. Sales Tax Setup

- Configure sales tax settings based on location and tax jurisdiction.

- Set up tax codes for taxable and non-taxable items.

3. Managing Inventory

A. Track Inventory Items

1. Item List

- Create inventory items for each product SKU.

- Include details like SKU, description, cost, price, and preferred vendors.

2. Inventory Adjustments

- Record adjustments for damaged, lost, or stolen inventory.

- Go to “Inventory” > “Adjust Quantity/Value on Hand.”

B. Inventory Reporting

1. Inventory Valuation

- Generate reports on inventory value and stock levels.

- Analyze inventory turnover and profitability.

2. Reorder Points

- Set reorder points to automate purchase orders.

- Ensure stock levels meet customer demand without overstocking.

4. Sales and Point of Sale (POS)

A. Process Sales Transactions

1. Sales Receipts and Invoices

- Create sales receipts for point-of-sale transactions.

- Generate invoices for sales on credit terms.

2. Discounts and Promotions

- Apply discounts, coupons, and promotions to transactions.

- Track promotional effectiveness and impact on sales.

B. Integration with POS Systems

1. POS Integration

- Sync QuickBooks with POS systems for real-time sales updates.

- Ensure accurate inventory management and financial reporting.

5. Customer Relationship Management (CRM)

A. Capture Customer Information

1. Customer Profiles

- Record customer details: name, contact information, purchase history.

- Use custom fields to capture specific customer preferences.

B. Loyalty Programs and Marketing

1. Loyalty Tracking

- Implement loyalty programs to reward repeat customers.

- Analyze customer data for targeted marketing campaigns.

6. Financial Management and Reporting

A. Financial Reports

1. Profit and Loss (P&L)

- Generate P&L statements to monitor retail profitability.

- Compare performance against budgeted goals.

2. Balance Sheet

- Review assets, liabilities, and equity for financial health assessment.

- Ensure accurate reporting of financial position.

B. Budgeting and Forecasting

1. Budget Creation

- Create budgets based on historical data and projected growth.

- Track actual performance against budgeted targets.

7. Security and Permissions

A. User Roles and Permissions

1. Access Control

- Assign roles (e.g., sales, inventory manager) with specific permissions.

- Restrict access to sensitive financial data to authorized users.

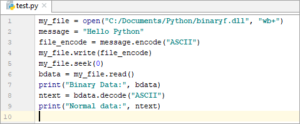

B. Data Backup and Security

1. Backup Procedures

- Regularly backup QuickBooks data to prevent loss.

- Store backups securely on-site or in the cloud.

8. Integration and Automation

A. Third-Party Integrations

1. E-commerce Platforms

- Integrate QuickBooks with e-commerce platforms for online sales tracking.

- Automate order fulfillment and inventory updates.

B. Automation Tools

1. Workflow Automation

- Use automation tools to streamline repetitive tasks (e.g., recurring invoices, inventory alerts).

- Improve operational efficiency and reduce manual errors.

9. Best Practices for Retail Management in QuickBooks

A. Regular Reconciliation

1. Bank Accounts and Transactions

- Reconcile bank accounts to ensure accuracy of financial records.

- Detect and resolve discrepancies promptly.

B. Continuous Training

1. User Education

- Train employees on QuickBooks usage and best practices.

- Ensure staff familiarity with new features and updates.

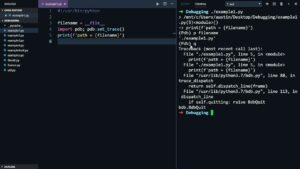

10. Troubleshooting and Support

A. Common Issues

1. Software Updates

- Keep QuickBooks updated to access new features and security patches.

- Address software compatibility issues promptly.

B. QuickBooks Support

1. Technical Assistance

- Contact QuickBooks Support for assistance with software issues.

- Visit the QuickBooks Support website for troubleshooting guides and resources.

C. Community Forums

1. User Community

- Engage with the QuickBooks Community for insights and advice.

- Participate in discussions on retail management strategies and solutions.

11. Conclusion

Setting up QuickBooks for retail involves careful planning and configuration to meet the unique needs of your business. By following this comprehensive guide, businesses can effectively manage inventory, streamline sales operations, enhance customer relationships, and optimize financial reporting using QuickBooks. Leveraging its features and integrations ensures that retail businesses can achieve efficiency, profitability, and growth in a competitive market landscape.